Trading Pattern Spotlight

Doji

Candlesticks

Doji candlesticks… This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler text. This is filler.

Tier

What Is a Doji Candle Pattern?

The American Express Gold Card is one of the most iconic credit cards on the market today. Credit newbies can only consider it with awe. Credit pros know it as one of the best rewards cards for everyday spending. If you’re looking to play the game, it offers great value.

Why Doji Candlesticks?

For the time being, this site is mostly just a data dump. Over time, it may become more useful to the outside observer. Who knows?

I don’t claim to be an expert on anyone I write about.

Hell, I hardly claim to be an expert on myself.

These profiles are largely for me. I use them to record and reference. In the future, I may make them more meaningful to the outside observer.

No guarantees. Let’s start small.

Local Highs & Lows

Most people know Gary as “that social media guy.” Makes sense. He’s one of—if not the—best at it on the planet.

Price Discovery

Many of my heroes talk about company culture. Gary’s idea of a “Honey Empire” is one of the best.

Indecision Indicator

Gary wants to buy the Jets. Big dream, but he has a practical plan for it. Luckily, he is documenting the journey.

Chart Narrative

Jesse is

What do You Need to KNow ABout Doji Candles?

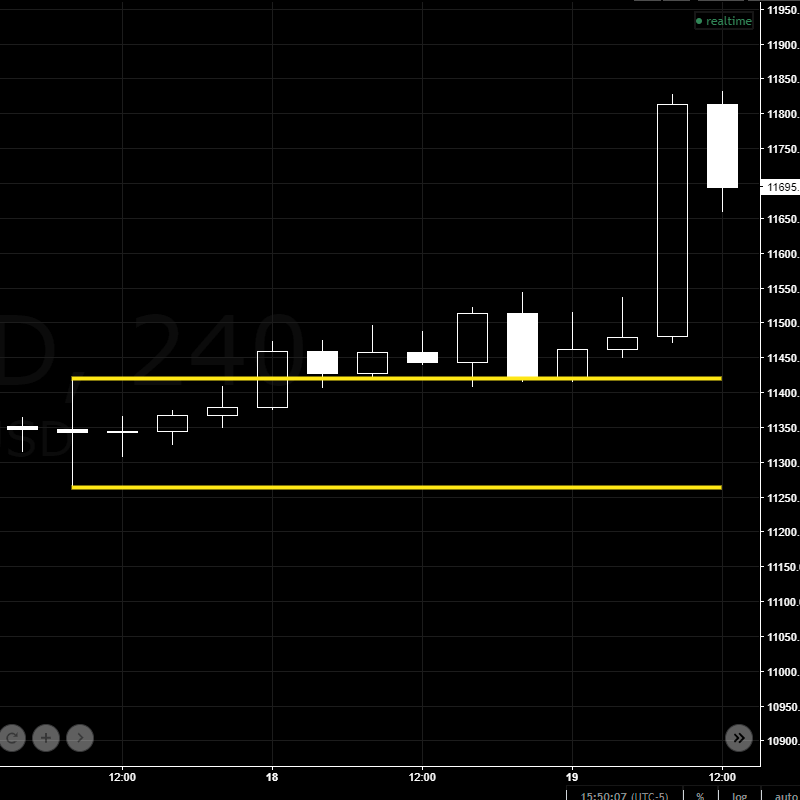

Price Ranges

Doji candles can help establish important price ranges.

In the example above/to the left, The doji candle set an important price range. It did not indicate which direction, but once a breakout, a continuation became more likely.

Once the breakout occurred, price returned to the top level, tested it as support, then continued upward.

Trade idea 1: set top range as stop loss after break out and let it run

Trade idea 2: after breakout, wait for retest of top range, get out if close below new support

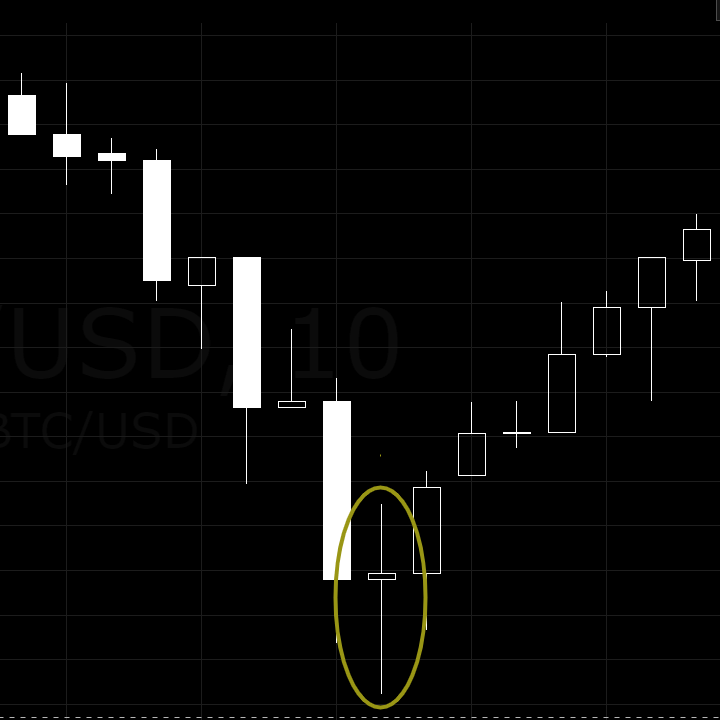

Reversals

Doji candles can help indicate price reversals.

combine with volume spike or golden/death cross

In the example above/to the left, the doji candle came in at the reversal point

Trade idea 1: buy after close above doji range (next candle after doji)

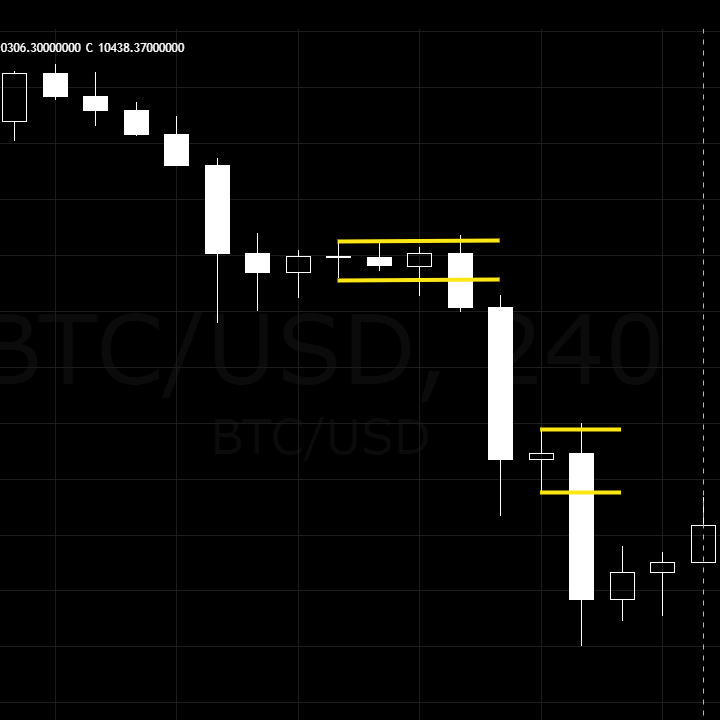

Continuation

Lay your foundation. This card is a good candidate for the sock drawer. Maintain the extra line of credit to build your credit profile. This card is a good candidate for the sock drawer. Maintain the extra line of credit to build your credit profile. This card is a good candidate for the sock drawer.

As Seen By Me

To me:

Jesse is part teacher, part citizen journalist.

He’d probably reject both of those titles. But I’ve learned a lot from him in a short time. And I enjoy his take on the news. He has a unique, entertaining type of wisdom.

He has helped me see some important truths.

It was over as soon as I heard him talk about forgiveness.

Jesse is one of those heroes like Jordan B. Peterson, that has shown me better ways to live out the principles I believe in.

Where Dojis Fit

Experienced traders know:

Nothing is the end-all-be-all when it comes to technical analysis.

Many credit cards offer peripheral benefits that may add value for you. The Gold Card has one of the best lineups.

- The Hotel Collection

- The Travel Collection

- AMEX Offers

- AMEX Access & Preferred Seating

Most users probably don’t need these to get positive expected value from the Gold Card. But they are available.

Best Links

Videos Watched

Books Read

Courses Completed

Mentions on My Site

How To Trade with Candlestick Patterns the Right Way

Candlesticks are the most popular way to chart price for stocks and other tradeable assets.

should understand them as a pass… understand the underlying story

recognize the most basic patterns in the market without indicators… just look at a chart and have a decent idea of what may happen next… not necessarily a prediction but some statistical probabilities… surely have different probababilites across different markets

Similar Candlestick Patterns

Spinning Tops

Darth Mauls

Hammers

My Top Three Trading Teachers

YouTube University is my go-to for trading training. I've completed several programs and keep up with these guys weekly.

Final CTA

Nice little subtitle for the win. Nice little subtitle for the win. Nice little subtitle for the win. Nice little subtitle for the win. or the win.